Quarterly Merchant Update

Q3 2023 Edition

product upgrades, case studies and more.

New payment options on tap for Shorty's Liquor.

Founded within the Woolworths Group, Wpay has unparalleled expertise in customer-led payment experiences for businesses across Australia and New Zealand.

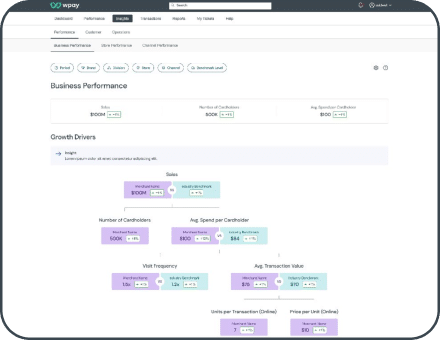

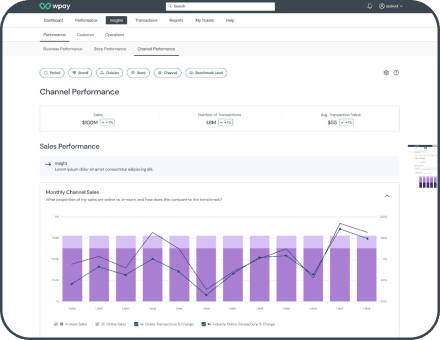

Is your business doing the business?

Get live insights in the Merchant Portal.

Performance

Now you can compare business wide sales and key growth drivers against industry benchmarks. Get a true idea of how your business is tracking.

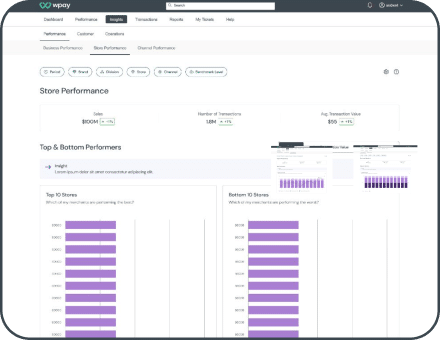

Performance

This new feature enables you to identify and compare top and bottom performing stores. Track against other industry benchmarks in your area.

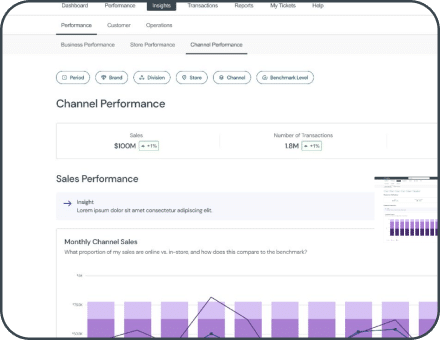

Performance

Want to compare apples with apples? This feature lets you compare sales performance of both online and in-store channels against industry benchmarks.

Behaviour

Gain a better understanding of the spend behaviour of your cardholders across all channels. Also, learn more about their loyalty to your business at the same time.

The latest news

on our latest products.

Terminal Release v735

This version includes a number of innovative updates to improve the terminal software on both the P400 and V400M. One outstanding highlight is the inclusion of an update for the printing function on the V400M. This gives users the ability to enable/disable receipt printing from the terminal directly with a # code. This will set the terminal to either print receipts on the terminal or not print, regardless of whether it is docked on the base. The change customer copy prompt will now only appear if receipt printing is enabled after the merchant copy has printed.

Quarterly CPAT release

Wpay has recently updated the quarterly card prefix acceptance table (CPAT) to include the new card ranges (BINS) released into the market by the card issuers. This update has been in effect since February 15th.

Wpay deploys CPATs around the middle of every quarter. Including one in February, May, then one in August and November.

Mastercard QPS

Mastercard have sunset the Quick Payment Service (QPS) program. Previously, this enabled a card to be inserted or swiped for transactions under $35 without the need for a pin or signature.

Moving forwards, cardholders will be prompted to enter a pin or provide a signature, depending on their card’s profile, for all transactions. These changes were included in the quarterly CPAT release in February.

Compliance.

Not just updated, upgraded.

Mastercard - Cardholder Verification Method

From April 1st 2023, Mastercard will be changing the cardholder Verification Method (CVM) limits from $200 back to $100 for contactless transactions.

In a return to pre-COVID processing, a pin will now be prompted for any contactless transaction exceeding $100.

Wpay will be deploying these changes from 27-29th March, ahead of Easter change freeze.

Visa – New Fraud Monitoring Program

From 1 April 2023, Visa will enhance their Visa Fraud Monitoring Program (VFMP) by implementing the Visa Digital Goods Merchant Fraud Monitoring Program. This program will focus on small ticket and digital goods merchant fraud transactions for the following merchant category codes (MCCs):- MCC 5735—Record Stores

- MCC 5815—Digital Goods Media—Books, Movies, Digital artwork/images, Music

- MCC 5816—Digital Goods—Games

- MCC 5817—Digital Goods—Applications (Excludes Games)

- MCC 5818—Digital Goods—Large Digital Goods Merchant

Merchants will be notified if the following thresholds are exceeded:

Standard

- USD 25,000 Fraud Amount; and

- 300 Fraud Count; and

- 0.9% fraud-dollar-to-sales-dollar ratio

- Month 1: Notification

- Month 2-4: Workout Period

- Month 5 (and subsequent months): Enforcement Period

Safe to say, your payment data has never been so secure.

The PCI Data Security Standard (PCI DSS) is a global standard that provides a baseline of technical and operational requirements to protect payment data. And PCI DSS v4.0 is the next evolution of the standard.

There have been a whole host of changes incorporated into the latest version to make it even safer. In fact, there’s so many, that we can’t list them all here.

But if you would like to see how secure your payment data has become, please refer to the Summary of Changes from PCI DSS v3.2.1 to v4.0, found in the PCI SSC Document Library.

On 28 October 2022, the Payment Application Data Security Standard (PA-DSS) was closed and replaced by the PCI Secure Software Standard.

To prepare for this transition, PCI commissioned a blog outlining all the relevant information. You can read it here.

Version 1.2 of the PCI Secure Software Standard introduces the Web Software Module. This is a a set of supplemental security requirements designed to address the most common security issues relating to internet-accessible payment technologies.

The PCI Security Standards Council (PCI SSC) has published a new standard to support the evolution of mobile payment acceptance solutions.

PCI Mobile Payments on COTS (MPoC) builds on the existing PCI Software-based PIN Entry on COTS (SPoC) and PCI Contactless Payments on COTS. (CPoC).

This enables merchants to accept cardholder PINs or contactless payments, using a smartphone or other commercial off-the-shelf (COTS) mobile device.

The PCI MPoC Standard provides increased flexibility not only in how payments are accepted, but in how COTS-based payment solutions can be developed, deployed, and maintained.

Registration is now open for 2023 PCI SSC training classes. Classes are offered either in-person or by remote Instructor-led eLearning.

Although all Wpay devices are V5 compliant, V4 users should note that the PCI Security Standards Council has changed the expiration date for PIN Transaction Security Point-of-Interaction (PTS POI) version 4 devices from 30th April 2023 to 30th April 2024. Upgrading to PTS POI v5-approved devices is recommended.

Keep tabs on your invoices with Wpay.

Our invoices now appear on the portal

You can now easily access your invoices via our portal. Just keep an eye out on the Invoices page after we’ve emailed the invoice to you. Please note, only certain roles will have access to this tab.

Review your chargebacks in the new Chargebacks Report

Our chargeback report puts any disputes into a format that can be more easily interpreted and acted upon. This enables you to track statuses and move quickly to redress any problems. It also lets you see the status of your chargebacks at a given point in time, as well as presenting a list of open transactions for merchants if they need to follow up.

You can download reports as: PNG, CSV, XLS

Wpay now offers role-based access

Merchants can now choose from a range of users. User Access Related Queries – Add/Remove a User and specify the type of user they want. Please note: everyone is currently assigned to Commercial & Finance Lead unless otherwise specified.

Reporting &

Financial Data User

Operational

Manager

Strategy &

Analysis Manager

Commercial &

Finance Lead

Create and track service tickets / requests

Visibility on invoices

Visibility on performance (e.g. Sales, Refunds)

Ability to see and download reporting and fee information