Quarterly Merchant Update

Q4 2023 Edition

product upgrades, case studies and more.

FY24 Strategy Day

The Wpay Strategy Day brought every team together to showcase and share our strategic ambitions, goals, and objectives for the year ahead.

Together, we look towards the future to deliver value to complex businesses through connected payment experiences.

Everything you need to know about PayTo

Wpay is thrilled to announce the launch of our new PayTo offering with Zepto. Join us in a curated conversation with Wpay’s Head of Product, Anthony Bracic, Marnie Ryan from AP+, NPPA, and Team Zepto, where we’ll explore the journey, future plans, and the excitement surrounding PayTo.

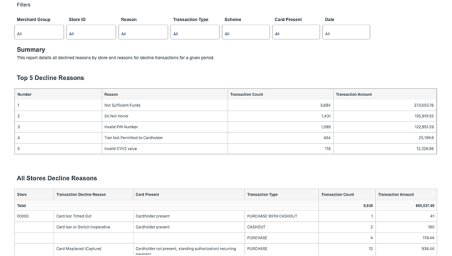

Check out these Merchant Portal updates

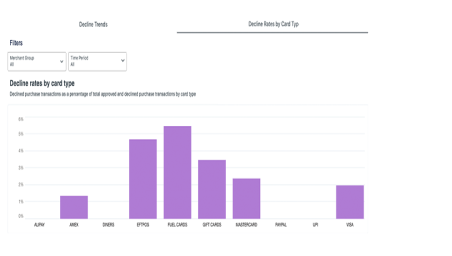

You can now analyse decline rates based on card types and even customise the time period. This allows you to gain valuable insights into the performance of different card types.

You can now see your decline amounts in addition to Decline Transaction Count & Decline Percentage. This provides clarity on the financial impact associated with declined transactions.

This update provides detailed insights into your top 5 decline reasons, categorised by store. You have the flexibility to filter the results based on store ID, reason, transaction type, scheme, and card present status.

Additionally, you can customise the specific day you want to analyse, allowing you to gather accurate and targeted data for your analysis.

The latest news on our latest products

Ready-to-go payments flow with our new Orchestration platform

Wpay is investing in a new Payment Orchestration Platform (POP) that is cloud native and resilient. Payment Orchestration is already live with Shortys, and we are actively assisting merchants making the the move to the new platform.

This upgrade will support simpler integration and go to market with the payment methods you need to reach your customers with dynamic rules for payment processing.

Additionally, we offer dynamic 3DS, enabling you to shift fraud responsibility to the card issuer for authenticated payments. Our Payment Orchestration Platform is now available, so upgrade today.

The capabilities we are ready with

Payment methods

Amex, Diners, JCB, Mastercard, Visa

Apple Pay, Google Pay, PayPal

AfterPay, Zip, PayPay (Pin4)

Security

Dynamic 3DS

Anti-Fraud

Integration methods

Direct API

Front End Orchestration drop in

Android SDK

iOS SDK

Magento Plugin

Compliance Updates

New tools for fighting fraud

Visa - Compelling Evidence 3.0

A new Compelling Evidence standard has been introduced to mitigate First Party Fraud (also known as Friendly Fraud).

What is First Party/Friendly Fraud?

Friendly Fraud occurs when a cardholder participates in a transaction or receives the purchased goods but then later dishonestly claim that they have not received goods and disputes the payment with their bank.

How does this update help fight fraud?

The new standard provides additional types of evidence that merchants can provide to challenge friendly fraud cases.

This includes evidence such as photographs, emails or previous payment history that link the customer raising the dispute to the merchandise/service that was provided.

How to flag this type of fraud:

Acquirers can flag disputes as a ‘compelling evidence’ case and Issuers must contact the customer and go through the evidence provided and explain why the dispute is still relevant.

The fine details:

Applicable to Visa dispute codes 10.4 (Card Absent Fraud) and 13.1 merchandise/services not received.

Settlement Updates

More flexible than ever

Flexible Settlement

12am cut-off

Wpay have introduced a new flexible settlement system aligned with our principle of simplicity and operational efficiency. The settlement window from 00:00 to 23:59 now provides merchants with a settlement aligned to the calendar date. As part of this update, EG Fuel is transitioning from our legacy settlement model to the new 12am settlement window.

Same Day Settlement

Another exciting update, Wpay’s new same day settlement ensures that merchants receive their funds within three hours of the end of trading. This provides a significant working capital relief by accelerating the receipt of funds. Live Group has expressed interest in opting in and is currently piloting this capability at three stores.

To find out more about same day settlement, have a chat with your account manager.

Flexible Billing Options for Merchants

At Wpay, we understand that scheme fees are an integral part of transaction costs for merchants, encompassing both international and domestic card transactions as well as Alternate Payment Methods (APMs). These fees are charged on a weekly, monthly, and quarterly basis, with varying rates based on transaction and service types. It’s important to note that these fees and charges are in addition to interchange fees.

To provide merchants with greater flexibility, Wpay have implemented scheme fee application models in our Billing Engine. This enables us to offer flexible billing options such as Blended, IC+, and IC++ to merchants, ensuring they have the billing structure that best suits their needs.

Knowledge is power

Stay on top of fraud trends

Beware of Phishing Scams

We continue to see fraud increase as a result of phishing scams and other card fraud using illegally obtained customer information. The latest fraud trend is as a result of E-Toll scams, whereby the customer is tricked into providing their card details. In some instances the fraudster is also able to pass some 2FA protection measures by simulating their own on the unsuspecting customer during the scam. The customer believes the code came from “E-Toll”, however in reality the fraudster has used their card online and forwarded the 2FA to the customer thereby passing the check.

Remember to never provide personal details to anyone you don’t know, avoid clicking any unknown hyperlinks and be cautious if a proposition involves payment.

Investing in Friendly Fraud prevention

Wpay’s CNP fraud prevention has never been better as we closed the year with significantly less loss than last year. However an increasingly alarming trend in card disputes and charge-backs that the retail industry is experiencing is more and more First Party Misuse or “Friendly Fraud”. 34% of retailers globally have experienced Friendly Fraud in 2023.

Rising interest rates and increased economic hardship in Australia have resulted in customers filing disputes with their banks to refund transactions that they knowingly paid for and/or received goods from. We estimate that nearly 30-40% of fraud loss is as a result of this type of fraud. Increased investment into fraud prevention tools are helping reduce this, such as; Improved credit card verification services, identity validation, two-factor phone authentication and 3-D Secure authentication.